- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

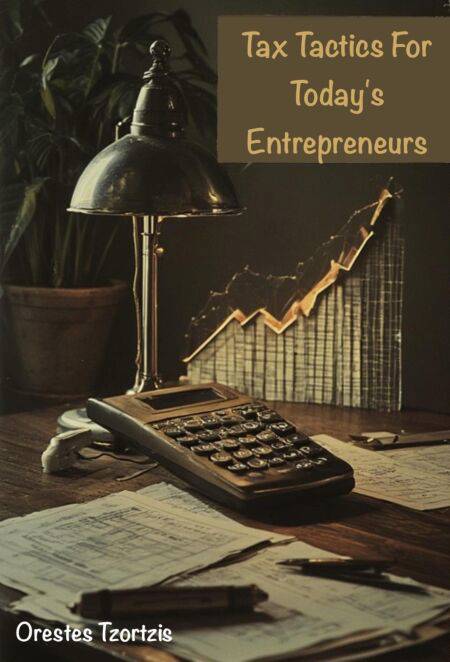

Tax Tactics for Today’s Entrepreneurs: Mastering IRS Rules in 2025 EBOOK

Orestes TzortzisDescription

In the rapidly evolving landscape of entrepreneurship, understanding tax considerations is paramount for success in 2025. This comprehensive guide meticulously outlines the latest IRS clarifications on deductions, including significant updates for Software as a Service (SaaS), cloud storage, and environmentally sustainable initiatives.

Delve into the intricacies of meal deductions, where business meals from restaurants now qualify for a full deduction—a game changer for networking and client relations. Learn about the mandated shift towards secure digital record-keeping essential for substantiating expenses, ensuring peace of mind during audits.

For startups navigating fluctuating revenues and varying tax classifications, this book provides vital strategies to mitigate challenges. It emphasizes the importance of audit preparedness through organized documentation and dedicated response teams. Freelancers will find crucial insights into income reporting and self-employment taxes, empowering them to take charge of their financial responsibilities.

Compliance is not merely a checklist; it is an ongoing strategic process that can minimize penalties and optimize tax positions. Equip yourself with the knowledge to thrive in this complex environment—explore this indispensable resource today!

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Langue:

- Anglais

Caractéristiques

- EAN:

- 9798231822409

- Date de parution :

- 26-08-25

- Format:

- Ebook

- Protection digitale:

- /

- Format numérique:

- ePub

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.