- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

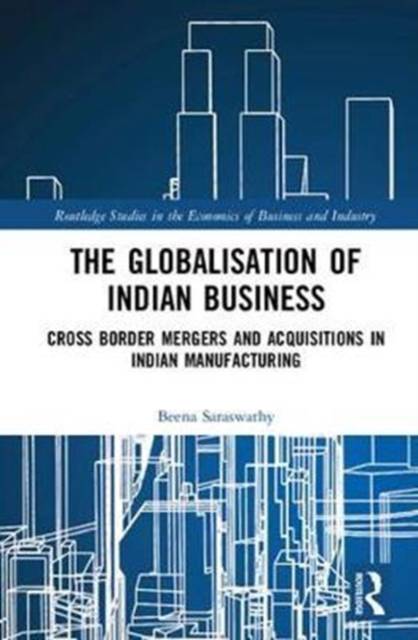

The Globalisation of Indian Business

Cross Border Mergers and Acquisitions in Indian Manufacturing

Beena SaraswathyDescription

Consolidation activities such as mergers and acquisitions (M&As) have been one of the major strategies adopted by Indian firms to withstand global competition. M&As experienced a substantial increase in value and volume during the post-liberalization era, facilitated by the presence of foreign subsidiaries in the Indian market as well as competitive pressure on domestic firms. The increased foreign investment through M&As brought new dimensions to the fore such as the implications on technological performance, efficiency, and more importantly, competition in the Indian market.

The Globalisation of Indian Business: Cross Border Mergers and Acquisitions in Indian Manufacturing provides an in-depth analysis of these issues, specifically aiming to understand whether the M&As strategies helped the firms to achieve their desired objectives in terms of improvement in technology, efficiency and market power in the context of the increase of M&As in India, using appropriate statistical and econometric techniques.

The book is of additional importance in the context of the recently implemented Competition Act, replacing the thirty year old MRTP Act in India. The new Act aims to maintain competition and protect consumers' interests without harming that of the producers'. Based on the analysis, broadly, the study cautions the regulators to rethink the efficiency defence argument and become more vigilant on the creation of monopolies. On the other side, it suggests firms should reconsider their post-merger integration strategy since consolidation has not led to a sustainable increase in market share of the surviving firms.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 166

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9781138740273

- Date de parution :

- 26-10-17

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 147 mm x 221 mm

- Poids :

- 408 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.